Denmark — 9 min

Global Payroll — 7 min

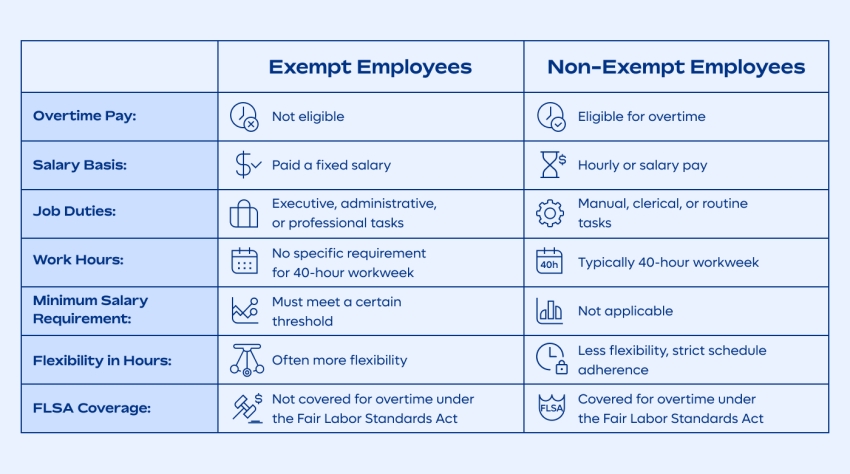

If you have team members in the United States, you need to understand whether they are classed as exempt or non-exempt employees.

But what exactly does that mean? And, more importantly, why does it matter?

In this article, we’ll explain the differences between the two, and lay out what impact the classification has on your payroll, compliance, and administration.

So let’s jump right in.

In the US, exemption refers to two types of employee: those who are eligible for overtime pay (non-exempt), and those who are not (exempt).

This distinction is defined under the federal Fair Labor Standards Act (FLSA). It is designed to protect non-exempt employees from unfair labor practices, by ensuring they are paid fairly when required to work overtime.

Let’s break this down further.

An exempt employee, as defined by the FLSA, usually holds a salaried position and is “exempt” from overtime pay regulations.

To qualify, the employee must earn more than the current federal exemption threshold of $684 per week, although in some states — Alaska, California, Colorado, Maine, New York, and Washington — the threshold is higher.

Eligibility is also defined by the duties and responsibilities of the role. Exempt employees usually perform high-level tasks that require independent judgment and expertise, and often carry executive, professional, or administrative responsibilities.

For example, a manager who oversees and makes key decisions in a certain department will likely fit into the “exempt” category. The distinction of being an exempt employee means that pay isn’t tied to the number of hours the employee works.

Non-exempt employees are typically paid hourly and, under the FLSA, are entitled to state minimum wage.

If they work more than a standard 40-hour work week, non-exempt employees are also entitled to overtime pay, which is calculated at a minimum of one-and-a-half times their regular hourly rate.

Instead of job duties, the main feature of non-exemption is the correlation between hours worked and compensation. This classification plays a vital role in protecting workers from being overworked without adequate compensation, and guarantees fair labor practices across industries.

If you’re still unsure whether your employee should be classed as exempt or non-exempt, consider the following:

Exempt employees typically have high-level responsibilities that might involve regular decision-making. As a result, they usually possess specialized education or knowledge.

Additionally, exempt employees are often required to exercise independent judgment in their role. For instance, administrative employees who formulate company policies or manage significant aspects of business operations are typically classified as exempt.

On the other hand, non-exempt employees usually perform tasks that are more routine and supervised. Their roles might include following set procedures and guidelines without the same level of decision-making authority as an exempt employee.

For example, a customer service representative following a script or a technician performing specific tasks under close supervision would typically be considered non-exempt.

It’s important to note that an employee’s job title has no bearing on whether they are considered exempt or non-exempt. Rather, their status depends on their actual level of responsibility and specific duties.

As mentioned, exempt employees are often salaried employees and aren’t eligible for overtime pay — regardless of how many hours they work. This means their compensation is fixed based on their salary agreement.

Non-exempt employees, however, are generally paid hourly and entitled to overtime pay. This means if they work more than 40 hours a week, they must be paid at least one and a half times their regular pay rate for each extra hour. In some states, these rates are slightly higher.

Note that the federal salary exemption threshold is due to change in 2024 (see “Proposed changes” section below).

Exempt employees often enjoy greater flexibility in their work schedules than non-exempt ones. Since their compensation isn’t directly tied to the number of hours they work each week, they have more freedom to manage their own time.

This flexibility allows them to adapt their schedules to meet personal needs or work demands. But it can also lead to longer weeks. Many executive employees, for instance, regularly work beyond the standard 40-hour workweek without receiving additional compensation.

In contrast, hourly employees typically have more structured work schedules, and their time is usually tracked. This structured approach ensures compliance with hourly wage tracking and overtime regulations.

Hourly workers are also often required to take scheduled rest breaks and adhere strictly to a 40-hour workweek so they don’t veer into overtime unless necessary.

Exemption status impacts your payroll and compliance.

Generally speaking, exempt employees provide businesses with predictable payroll. Employee salaries remain fixed, regardless of hours worked.

However, non-exempt workers — who are often hourly employees — require careful management to adhere to overtime rules. This means tracking their hours accurately to prevent unexpected overtime costs.

If you fall foul of FLSA regulations, you may be exposed to significant financial penalties. The Department of Labor (DoL) has the authority to impose fines on employers found in violation of the FLSA, as well as additional damages determined in court.

In addition, you may face lawsuits from aggrieved employees who are entitled to back pay.

To ensure that you are running your payroll correctly and complying with the FLSA, you need to have a basic understanding of the law itself.

Here’s what you need to know.

Federal minimum wage

The FLSA establishes the federal minimum wage, which is currently $7.25 per hour. This serves as the minimum pay that employers must provide to their employees.

Note that this is the federal minimum; many states set higher minimum wages (and review them annually). In instances where the state minimum is higher than the federal minimum, employers must pay the state minimum.

Hour regulations

The FLSA sets out several rules regarding working hours. This includes defining the full-time workweek, and prescribing requirements on how to record hours worked. These provisions are in place to ensure that employees receive fair compensation for their time, especially in cases involving overtime hours.

Youth employment

The FLSA also includes provisions concerning youth employment. Specifically, it outlines the types of permissible work and the maximum hours per week for individuals under 18. These regulations are designed to protect young workers from exploitation and exposure to hazardous working conditions.

As an employer, adherence to the FLSA is not just a legal requirement; it’s an ethical responsibility, too. You must ensure your non-exempt employees are paid at least the minimum wage, and that they are fully compensated for any overtime.

In addition to these requirements, you must also maintain precise records of hours worked and wages paid to all employees. These records are essential for demonstrating compliance with labor laws, and can even serve as evidence in disputes or investigations.

As mentioned, aspects of the FLSA are currently being reviewed by the US government. Under proposed changes by the DoL, the federal salary threshold for exempt workers is expected to rise from $684 to $1,059 per week, which will expand overtime eligibility to more employees.

This is a significant change, as many currently exempt employees will become eligible for overtime pay.

These changes are expected to be implemented in 2024.

If you have employees in the US, it’s important to understand the difference between your exempt and non-exempt employees, and manage their status accordingly.

Remote can streamline and simplify this process for you. With our platform, you can easily track your employees’ attendance and hours, and pay them quickly and compliantly without the headache of manual calculations and deductions.

We can also help you hire and onboard quickly, provide attractive benefits, and manage the day-to-day HR needs of your workforce.

To learn more about how we can simplify your payroll and HR needs, speak to one of our friendly experts today!

Hire and pay your global team with Remote and get access to our team of global taxation experts.

Subscribe to receive the latest

Remote blog posts and updates in your inbox.